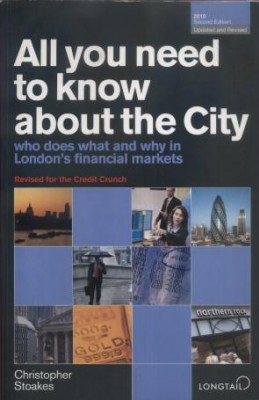

Book description

The global financial crisis has made what goes in the City of London’s financial markets more important and relevant than ever. What is the credit crunch and sub-prime lending? What are toxic tranches and SIVs and why do they matter? If you’re working in, or are thinking of working in the City, this book gives you the answers. Designed to be a quick and easy read, it explains what everything is and how it all connects.

CONTENTS:

INTRODUCTION

1. THE CITY AS A MARKET & THE GLOBAL CREDIT CRUNCH

2. WHY COMPANIES NEED MONEY

3. WHAT HAPPENS WHEN A COMPANY FLOATS

4. M & AS (AND MORE ON MBOS)

5. MY WORD IS MY BOND: DEBT SECURITIES

6. WHAT’S A BANK?

7. MORE ON COMMERCIAL BANKING

8. MORE ON INVESTMENT BANKING

9. MARKET WHALES – INSTITUTIONAL INVESTORS

10. GOING FOR BROKE

11. THE MECHANICS OF MARKETS

12. BIG PICTURE STUFF: THE IMPACT OF ECONOMICS

13. DERIVATIVES, SYNTHETICS AND ALL THAT JAZZ

14. THE ALCHEMY OF SECURITISATION

15. LLOYD’S OF LONDON & THE REINSURANCE MARKET